🏠 Introduction

If you’ve ever considered selling your home quickly, you’ve probably seen or heard ads from a real estate investor offering to buy houses fast, with cash, and in any condition. These promises sound attractive—especially for homeowners in a hurry or with properties needing work. But how do you know if the real estate investor you’re working with is serious about buying your home… or just trying to flip your contract for a profit?

Here’s how to separate the legitimate real estate investors from the red flags—and why asking the right questions matters.

1. Understand What a Real Estate Investor Can Offer

Working with a real estate investor can simplify your home-selling process. Most investors:

Pay in cash or use private financing

Skip inspections and appraisals

Close in as little as 7–14 days

Buy homes in “as-is” condition, no repairs or cleaning needed

This can be an ideal option if you’re facing foreclosure, relocating quickly, dealing with an inherited property, or just want a stress-free sale.

2. Ask: “Are You the Actual Buyer or Just a Middleman?”

This is the most important question to ask. Some people claiming to be real estate investors are actually “wholesalers.” These individuals:

Get your property under contract

Then try to assign (sell) that contract to another buyer for a higher price

Never intend to actually purchase your house themselves

This often leads to:

Delays in closing

Frustration for the seller

Canceled deals if they can’t find another buyer in time

If the person can’t confidently say they are the one closing the deal, that’s a red flag.

3. Look for Transparency from the Real Estate Investor

A trustworthy real estate investor will:

Explain their process clearly

Show proof of funds if needed

Be honest about the timeline and any contingencies

Put everything in writing

If you sense vague answers or pressure tactics, take that as a sign to dig deeper, or walk away.

4. Treat This Like Hiring a Professional, Interview Multiple Real Estate Investors

Just like you’d meet with several Realtors before listing your home, it’s wise to talk to more than one real estate investor. Compare:

Their offer price

Their ability to close

Their communication style

It’s not just about price, it’s about confidence that they’ll follow through.

5. Trust Your Gut When Talking to a Real Estate Investor

This might sound simple, but it’s often the most accurate tool you have. If a real estate investor makes you feel uneasy, listen to that instinct. Someone who truly wants to buy your home should:

Be respectful of your time and situation

Listen to your needs

Not pressure you into a decision

If something feels off, move on.

6. Check the Real Estate Investor’s Track Record

Ask for:

Past transactions or references

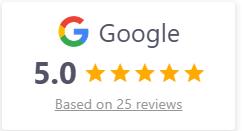

Online reviews

A website or business presence

Established real estate investors are proud of their reputation and can point to satisfied sellers they’ve helped before. Avoid anyone who won’t provide credibility.

7. Understand the Contract Before You Sign

Before accepting any offer, have someone you trust (like an attorney) review the agreement. A good real estate investor will not rush or discourage this. Make sure the contract:

Clearly names the buyer (not just “and/or assigns”)

Has a defined closing date

Doesn’t include suspicious contingencies

Final Thoughts: Be Smart, Be Safe

Selling your house to a real estate investor can be the easiest, fastest way to get cash in hand and move on with your life, but only if you choose the right one. Ask questions, trust your gut, and work with someone who treats you with professionalism and respect.

continue reading

Related Posts

How Cash Home Buyers Calculate Offers Why This Question Matters

The industry includes both ethical operators and bad actors. The safest approach is not to avoid the option entirely—but to understand it fully...

Selling a house for cash is one option among many. For some sellers, it solves real problems. For others, it doesn’t make financial sense. The best decision comes from understanding...